End the Payday Loan Cycle. Gain Control of Your Finances Today!

Get A Step By Step Plan To Reduce Payday Loan Debt For Free

Escape the stress of high payments and endless interest. Our payday loan relief experts will secure the lowest possible monthly payment from your creditors, showing you the timeline and savings upfront, with no obligations.

See Your New Payment Plan In The Next 10 Minutes.

Fill In Your Contact Info To Get A Free Quote!

* We will never share your details or send you spam.

* Our team will evaluate your loans and negotiate directly with creditors to lower your monthly payments and interest rates.

Your Current Situation:

Payday Loans Owed:

You've indicated that you owe over $5,000. This places you in a challenging category for payday loan debt relief.

Primary Goal:

Your goal is to get out of payday loan debt as quickly as possible, a very achievable objective with our tailored programs as you'll see below.

Special Offer! Schedule a free consultation & get a complimentary vacation

4-day stay in a premium accommodation or an all-inclusive resort or a 5-day cruise to the Caribbean. Yes, seriously!

Get A Personalized Payday Loan Report

HOW SOLID GROUND FINANCIAL CAN HELP

Since you owe over $5,000 your path to financial freedom requires a robust plan, executed by an expert payday loan consolidation team that is backed by an attorney.

Our program for higher debt levels includes:

Step By Step Payday Loan Relief Process:

How It Works and How We Can Help You

Below is the exact process a debt consolidation company would implement to settle your debt.

Advantages of Getting

Payday Loan Relief Now:

Next Steps:

Free Consultation

Call us now or schedule a no-obligation consultation to discuss your specific situation, potential monthly payments, new interest rates, and a timeline for debt freedom.

Tailored Payment Plan

Based on the consultation, we'll design a payment plan that fits your budget and goals.

Debt Consolidation Program Enrollment

Start your journey to debt freedom by enrolling in our program, designed to get you out of debt in the shortest time possible.

Why Solid Ground Financial?

Learn How To Escape Payday Loan Debt

With Our Proven Process

We understand that choosing to seek help is a big step. At Solid Ground Financial, we're committed to being your partner every step of the way. Let's take that step together and put you back in control of your finances. Thank you for trusting us with your financial future.

In our 15-minute meeting you will leave knowing the following:

Special Limited Time offer - We're giving away vacations!

Get A Complimentary Getaway For Attending Our Meeting

A Value of Up To $2,500 In Travel Gifts

Promotion Details:

Important!

6 GIFTS

Travel Rewards

See all the gifts we're giving away for attending our meeting.

Sign up to redeem a dream vacation this week!

GIFT 1

5-Day Stay in the USA

GIFT 2

Hotel & Flights in the USA

GIFT 3

7 to 5-Day International Stay

GIFT 4

All-Inclusive Resort

GIFT 5

5-Day Cruise

GIFT 6

Bluetooth Smart Devices

About Us

[Solid Ground Financial]

Solid Ground Financial has over 15 years of experience helping people get out of debt and consolidating payday loans.

Our payday loan consolidation program will give you control of your bank account and put you back in the drivers seat with your finances.

Solid Ground Financials' team of professionals are trained to design a payment plan that not only makes you feel comfortable but also can fast-track your payday loan relief program in the shortest amount of time. Our programs are designed on your budget, not your credit score!

⭐We proudly have over 900 reviews on google with a 4.9 star rating

100%

MONEY BACK

GUARANTEE

We Offer A Risk-Free Payday Loan Consolidation Backed By An Attorney with a 100% Money Back Guarantee and a Proven Track Record of Helping Clients Eliminate Debt

Our debt consolidation program has the best guarantee in the payday loan industry. If for any reason we are unsuccessful we will refund 100% of your money, guaranteed.

Solid Ground Financial has a 99% success rate helping clients consolidate their payday loans. Once you're a client of ours you will have access to a dedicated account manager that will help reduce your monthly payments by an average of 50% and even reduce or eliminate your interest rates!

Our mission is to get you out of debt and teach you how pay off your payday loans with our debt consolidation program.

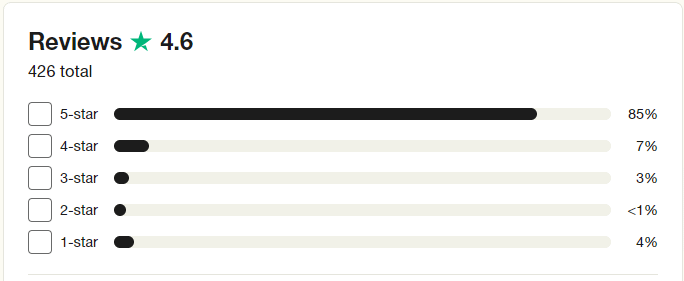

⭐We proudly have over 400 reviews on Trustpilot.com with a 4.6 star rating

*

Here's A Recap Of The Great Offer You Can Take Advantage Of Today!

Schedule 15-minute meeting with a debt settlement advisor to get the following benefits and gifts for attending.

In Our Meeting You Will Leave Knowing The Following:

Attend Our Meeting To Redeem These Rewards:

Schedule A Meeting Today!

Thank you for your interest in scheduling a quick meeting with Solid Ground Financial!

Here's what to expect and how we will help you with your payday loan debt.

1.) We'll learn more about you, like your creditor's names, how many payday loans you have, and how much you owe.

2.) We'll run your balance through our creditor database, and apply for the lowest monthly payment your creditors will accept.

3.) Within a few minutes, you will know your new consolidated monthly payment and how many months you have to pay it off.

There is no obligation to join our program but if your new monthly payments will save you thousands of dollars in payments and interest, then we can start the process of helping you become debt-free.

Choose a day and time that's convenient for you and we look forward to meeting you.

Thank you, have a great day!

We're Excited To Meet You!

FAQ

See Our Most Commonly Asked Questions

Everything you need to know about payday loan debt consolidation

Payday Loan Relief and Debt consolidation are not the same.

In many cases a payday loan relief program is the way to pay your payday loans at a fraction of the balance, based on what you have paid to the lender already.

A debt consolidation program would pay these loans off in full without any questions asked.

You should consider a payday loan relief program when your not able to pay your payday loans.

Payday Loan relief would give you back control of your checking account and you can pay your payday loans on your terms vs. not being in control of your finances.

There are two different types of payday loan relief programs.

One being a debt settlement program which negotiates with your lenders for a faster lower payoff.

A Debt consolidation program would pay these loans off in full with the interest given by the lender.

In most cases a payday loan settlement program is your best option.

Debt consolidation involves restructuring your existing interest rates with your creditors.

We consolidate all your accounts into one convenient monthly payment. (If you are late we can stop the late and over-limit fees).

You can read this Wikipedia article on debt consolidation to fully understand what it is.

The consolidation process results in lower monthly payments, reduced interest rates, and elimination of over-limit fees and late fees.

Moreover, the payoff term is drastically reduced. Interest Rates are lowered in between 6 and 9%!!

Credit Counseling agencies have established relationships with major creditors across the country, both large and small.

Creditors are typically willing to work to facilitate the repayment of money owed by lowering monthly payments and reducing or eliminating an individual’s interest rates and late fees.

Bankruptcy is usually the last resort you should want to take in solving your financial problems.

Many individuals aren’t even aware of the consequences this can cause. Bankruptcy will stay on your credit report for at least 7 years. Future creditors more than likely won’t even consider extending credit to someone who has filed bankruptcy.

Debt Consolidation is your best and safest alternative if you’re considering bankruptcy.

All unsecured debts can be successfully consolidated with our Debt Consolidation program. Credit Cards, Department store cards, medical bills, utility bills, unsecured loans, and Payday Loans.

No, Debt Consolidation does not hurt your credit.

Rest assured, you can refer to MyFICO.com which states that credit counseling does not effect your credit nor score in any way.

Some Debt Consolidation companies fail to disclose that you should make your minimum payment while enrolled in the program. If these minimum payments aren’t made during the initial setup, it could have negative effects on your credit.

The difference between secured and unsecured debt is the following. Secured debt normally has collateral attached to it, which secures the debt. Examples: Your home mortgage. Your car loan, even your motorcycle. These are secured debts. Unsecured debt is a little bit different. Unsecured debt does not have any collateral. Examples: Credit Card Debt, Medical Bills, Department Stores, Signature Loans, Payday Loans, and installment loans. These all just require a credit check and your signature.

You can get out of your payday loans almost just as fast as you applied for them.

Simply close your checking account** and consolidate your accounts into one comfortable monthly payment. Your lenders will have to be contacted immediately once you start the Payday Loan Consolidation Program.

With this program it will give you back control of your checking account and most importantly your piece of mind.

Solid Ground Financial can get you the Payday Loan Help you deserve.

1. Close Your Checking Account**

2. Gather Your Statements

3. Call Us For a quick and easy quote

4. Go Over Your Budget to make a sensible plan that you are confident in

5. Return Paperwork to Service Provider to contact lenders

6. Enjoy stress-free Debt Consolidation help!

**Do not close account until you have spoken to one of Solid Ground Financial’s representatives. Call 1-877-785-7817 or Apply Online Today!

The payments are calculated based on the creditor guidelines. Depending on what type of debt it is that will determine your payments.

The programs can work with, credit cards, department stores, payday loans, installment loans, student loans and any unsecured debt.

Payday Loan Consolidation is designed to work with your lenders directly. These lenders will work through the program to consolidate your accounts.

The Payday Loan Consolidation Program will consolidate your accounts into one monthly payment, while the program will give you back control of your checking account and paychecks.

No. Payday Loan Consolidation is a proven method to ease the mental stress of Payday Loan Debt without posing risk to clients.

Payday Loan Consolidation Program is back with a 100% guarantee and the Legal Protection Plan for those “just in case” moments.

If ANY lender takes you to court you will have legal coverage in your state, county and local courthouse.

Yes. The utmost important thing with Payday Loan Consolidation is the companies experience in the Debt Consolidation industry by always keeping your best interest first.

Majority of Payday loan lending companies are often on Indian Reservations or sovereign land, making it extremely difficult to establish relationships with your lenders and even harder to provide you with Payday loan debt relief.

With over 10 years of experience, Solid Ground Financial takes pride in delivering you consistent and efficient help with Payday loans!

Check out the this Wikipedia article on Payday loans in the United States.

Once you have one or more payday loans and they are debiting from your account once payday arrives. By starting our reputable payday loan program you would be able to gain control of your banking account as well as your paychecks.

Always be sure to contact an experienced Payday Loan Consolidation company with proven results in Payday Loan Assistance Programs. Always use a company that has a proven track record and supporting reviews from their clients.

Yes. In essence consolidating your Payday Loans is assisting you with your overall debt without harming your credit.

Get The Financial Help Your Looking For

Reduce your payday loan debt by 30% to 70%! Contact us to find out how.

© 2024 Solid Ground Financial. All rights reserved.

*Solid Ground Financial is a Debt Relief Referral Service

*Solid Ground Financial Does Not Provide Loans to Consumers

*We do not provide referrals for loans. We do not offer payday loans