Overwhelmed By Over $2,500 In Payday Loans or Credit Card Debt?

Speak with our financial specialists to run your debt through our creditor database to know within minutes:

Sign Up To Get A Free Consultation!

Our debt advisor will create a customized plan to assist you in becoming debt-free. The plan will include a timeline and budget that are tailored to your unique situation.

Disclosure: Solid Ground Help INC is not a lender and does not provide personal loans or payday loans. We are a nonprofit financial counseling company that guides people on how to consolidate their personal loans into one affordable monthly payment.

We do not charge any upfront fees or interest for our service. We work with your lenders to reduce the amount you owe and help you get out of debt faster.

We are not affiliated with any personal loan companies or other financial institutions. We are an independent, third-party service that acts in your best interest. By using our service, you agree to our terms and conditions and privacy policy.

FREE ONLINE ANALYSIS

Get A Step By Step Plan To Get Out Of Payday Loans or Credit Card Debt In Under 1 Year

If you have over $2,500 in debt, we can help you reduce your payments and lower interest rates by consolidating your payday loan debt into one affordable monthly payment.

Complete our quick 3 question survey to get a detailed report personalized to your financial situation showing you the most immediate steps you can take to eliminate your debt.

Why work with us

Solid Ground Financial does not charge upfront until we have negotiated with your lenders and have successfully reduced or eliminated your payments. We offer risk-free payday loan debt consolidation backed by an attorney with a 100% money back guarantee and a proven track record of helping clients eliminate debt.

Our debt consolidation program has the best guarantee in the payday debt relief industry. If for any reason we are unsuccessful we will refund 100% of your money, guaranteed.

Solid Ground Financial has a 99% success rate helping clients consolidate their debt. Once you're a client of ours you will have access to a dedicated account manager that will help reduce your monthly payments by an average of 50% and even reduce or eliminate your interest rates!

Our mission is to get you out of debt and teach you how pay off your payday loans with our debt consolidation program.

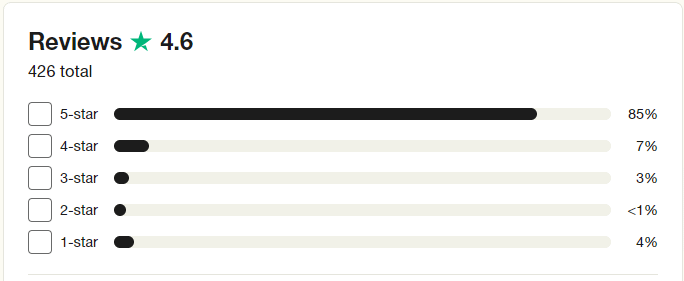

⭐We proudly have over 400 reviews on Trustpilot.com with a 4.6 star rating

Why work with us

Risk-Free Payday Debt Consolidation with a 100% Money Back Guarantee and a Proven Track Record of Helping Clients Eliminate Debt

Our debt consolidation program has the best guarantee in the debt industry. If for any reason we are unsuccessful we will refund 100% of your money, guaranteed.

Solid Ground Financial has a 99% success rate helping clients consolidate their payday loans. Once you're a client of ours you will have access to a dedicated account manager that will help reduce your monthly payments by an average of 50% and even reduce or eliminate your interest rates!

Our mission is to get you out of debt and teach you how to pay off your pay off your payday loans with our debt consolidation program.

⭐We proudly have over 400 reviews on Trustpilot.com with a 4.6 star rating

Why work with us

Solid Ground Financial does not charge upfront until we have negotiated with your lenders and have successfully reduced or eliminated your payments.

Risk-Free payday loan debt consolidation with a 100% money back guarantee and a proven track record of helping clients eliminate debt.

Our debt consolidation program has the best guarantee in the payday loan industry. If for any reason we are unsuccessful we will refund 100% of your money, guaranteed.

Solid Ground Financial has a 99% success rate helping clients consolidate their payday loans.

Once you're a client of ours you will have access to a dedicated account manager that will help reduce your monthly payments by an average of 50% and even reduce or eliminate your interest rates!

Our mission is to get you out of debt and teach you how to pay off your pay off your payday loans with our debt consolidation program.

⭐We proudly have over 400 reviews on Trustpilot.com with a 4.6 star rating

Get Your Free Payday Debt Analysis

Learn what you need to do to get out of debt

Your Payday Debt Relief Report Is A Step-By Step Plan Showing You...

1.

Discover how to reduce your monthly payments up to 50%

2.

Find out how to reduce your interest rates up to 75%

3.

Learn how to payoff all of your debts sooner

4.

How to stop late and over-limit fees

5.

How to stop annoying collection calls

Eliminate Your Debt Guaranteed

Complete a quick survey to get your plan to be payday loan debt free

About us

Solid Ground Financial has over 15 years of experience helping people get out of debt.

Our payday debt consolidation program will give you control of your bank account and put you back in the drivers seat with your finances.

Solid Ground Financials' team of professionals are trained to design a payment plan that not only makes you feel comfortable but also can fast-track your payday debt relief program in the shortest amount of time. Our programs are designed on your budget, not your credit score!

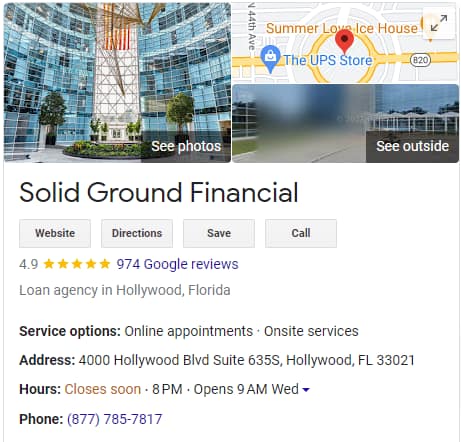

⭐We proudly have over 900 reviews on google with a 4.9 star rating

FAQ

See Our Most Commonly Asked Questions

Everything you need to know about payday loan debt consolidation

Payday Loan Relief and Debt consolidation are not the same.

In many cases a payday loan relief program is the way to pay your payday loans at a fraction of the balance, based on what you have paid to the lender already.

A debt consolidation program would pay these loans off in full without any questions asked.

You should consider a payday loan relief program when your not able to pay your payday loans.

Payday Loan relief would give you back control of your checking account and you can pay your payday loans on your terms vs. not being in control of your finances.

There are two different types of payday loan relief programs.

One being a debt settlement program which negotiates with your lenders for a faster lower payoff.

A Debt consolidation program would pay these loans off in full with the interest given by the lender.

In most cases a payday loan settlement program is your best option.

Debt consolidation involves restructuring your existing interest rates with your creditors.

We consolidate all your accounts into one convenient monthly payment. (If you are late we can stop the late and over-limit fees).

You can read this Wikipedia article on debt consolidation to fully understand what it is.

The consolidation process results in lower monthly payments, reduced interest rates, and elimination of over-limit fees and late fees.

Moreover, the payoff term is drastically reduced. Interest Rates are lowered in between 6 and 9%!!

Credit Counseling agencies have established relationships with major creditors across the country, both large and small.

Creditors are typically willing to work to facilitate the repayment of money owed by lowering monthly payments and reducing or eliminating an individual’s interest rates and late fees.

Bankruptcy is usually the last resort you should want to take in solving your financial problems.

Many individuals aren’t even aware of the consequences this can cause. Bankruptcy will stay on your credit report for at least 7 years. Future creditors more than likely won’t even consider extending credit to someone who has filed bankruptcy.

Debt Consolidation is your best and safest alternative if you’re considering bankruptcy.

All unsecured debts can be successfully consolidated with our Debt Consolidation program. Credit Cards, Department store cards, medical bills, utility bills, unsecured loans, and Payday Loans.

No, Debt Consolidation does not hurt your credit.

Rest assured, you can refer to MyFICO.com which states that credit counseling does not effect your credit nor score in any way.

Some Debt Consolidation companies fail to disclose that you should make your minimum payment while enrolled in the program. If these minimum payments aren’t made during the initial setup, it could have negative effects on your credit.

The difference between secured and unsecured debt is the following. Secured debt normally has collateral attached to it, which secures the debt. Examples: Your home mortgage. Your car loan, even your motorcycle. These are secured debts. Unsecured debt is a little bit different. Unsecured debt does not have any collateral. Examples: Credit Card Debt, Medical Bills, Department Stores, Signature Loans, Payday Loans, and installment loans. These all just require a credit check and your signature.

You can get out of your payday loans almost just as fast as you applied for them.

Simply close your checking account** and consolidate your accounts into one comfortable monthly payment. Your lenders will have to be contacted immediately once you start the Payday Loan Consolidation Program.

With this program it will give you back control of your checking account and most importantly your piece of mind.

Solid Ground Financial can get you the Payday Loan Help you deserve.

1. Close Your Checking Account**

2. Gather Your Statements

3. Call Us For a quick and easy quote

4. Go Over Your Budget to make a sensible plan that you are confident in

5. Return Paperwork to Service Provider to contact lenders

6. Enjoy stress-free Debt Consolidation help!

**Do not close account until you have spoken to one of Solid Ground Financial’s representatives. Call 1-877-785-7817 or Apply Online Today!

The payments are calculated based on the creditor guidelines. Depending on what type of debt it is that will determine your payments.

The programs can work with, credit cards, department stores, payday loans, installment loans, student loans and any unsecured debt.

Payday Loan Consolidation is designed to work with your lenders directly. These lenders will work through the program to consolidate your accounts.

The Payday Loan Consolidation Program will consolidate your accounts into one monthly payment, while the program will give you back control of your checking account and paychecks.

No. Payday Loan Consolidation is a proven method to ease the mental stress of Payday Loan Debt without posing risk to clients.

Payday Loan Consolidation Program is back with a 100% guarantee and the Legal Protection Plan for those “just in case” moments.

If ANY lender takes you to court you will have legal coverage in your state, county and local courthouse.

Yes. The utmost important thing with Payday Loan Consolidation is the companies experience in the Debt Consolidation industry by always keeping your best interest first.

Majority of Payday loan lending companies are often on Indian Reservations or sovereign land, making it extremely difficult to establish relationships with your lenders and even harder to provide you with Payday loan debt relief.

With over 10 years of experience, Solid Ground Financial takes pride in delivering you consistent and efficient help with Payday loans!

Check out the this Wikipedia article on Payday loans in the United States.

Once you have one or more payday loans and they are debiting from your account once payday arrives. By starting our reputable payday loan program you would be able to gain control of your banking account as well as your paychecks.

Always be sure to contact an experienced Payday Loan Consolidation company with proven results in Payday Loan Assistance Programs. Always use a company that has a proven track record and supporting reviews from their clients.

Yes. In essence consolidating your Payday Loans is assisting you with your overall debt without harming your credit.

Becoming Debt Free Starts Here!

Look no further, Solid Ground Financial is the help you are searching for.

Our Office In South Florida

Our Mission

SolidGroundHelp.com is a non profit organization with a mission to empower others through financial literacy, and to provide information on how to take advantage of debt resolution options that are available to them through credit counseling. Giving consumers the opportunity to release themselves from the burden of unwanted debt can not only strengthen credit worthiness, it can also save lives.

Our Counseling Services

SolidGoundHelp.com does not charge for counseling or coaching, you can contact us right now and get expert advice on all financial topics for free. If you're interested in a loan consolidation service we do not charge upfront until we have negotiated with your lenders and have successfully reduced or eliminated your payments.

Telephone Counseling

We will perform a live detailed budget analyst with the client. This process will allow us to determine the clients true hardship and debt to income ratio. In addition to a free soft credit pull and credit review with the client.

Financial Literacy

ln a world where Financial literacy is not common we provide detailed information to consumers in need. Any question you may have please contact us to speak with an expert financial advisor.

Credit Coaching

Understanding debt is critical to living a debt free life. We believe in empowering individuals with our credit counseling program, designed to protect consumers from falling victim to unwanted debt.

Get The Financial Help Your Looking For

Complimentary coaching and counseling to guide you to financial success.

© 2024 Solid Ground Financial. All rights reserved.

*Solid Ground Financial is a Debt Relief Referral Service

*Solid Ground Financial Does Not Provide Loans to Consumers

*We do not provide referrals for loans. We do not offer personal loans.